Bitcoin Casinos

A complete guide to bitcoin casinos

- Greg Walker

- 13 Jun 2025

Here's everything you need to know about using bitcoin to play at online casinos.

You may be completely new to bitcoin, or you may already have some and want to know which online casinos accept bitcoin and are the most reliable. Either way, this guide is for you.

Why should you trust my advice?

Because I've been working with bitcoin on a technical level since 2014. I've built my own blockchain explorer, written a technical guide to bitcoin for beginners, and written multiple bitcoin-specific tools.

In other words, I know how bitcoin works.

I don't know how you found this page, but I'm guessing you trawled a sea of "bitcoin casino" guides to get here. Welcome to the end of your search.

Which bitcoin casinos are the best?

These are the best bitcoin casinos I know as of 2025.

I've ranked them based on trustworthiness and how quickly bitcoin withdrawals are processed. I've been involved with online gambling for over 15 years, so I know a good online casino when I see one.

| Rank | Casino | Rating | Payment Methods | Payout Time | Links | |

|---|---|---|---|---|---|---|

| 1 |

|

Rating A+ | Payment Methods |

Balance

Fiat

|

Payout Time 1-2 Days | Play Now Read Review |

| 2 |

|

Rating A | Payment Methods |

Balance

Fiat

|

Payout Time 1-2 Days | Play Now Read Review |

This isn't an exhaustive list of all bitcoin casinos. These are just ones I know to be extremely reliable and pay out to winners.

Why play at a bitcoin casino?

Bitcoin-specific casinos have the following benefits:

- Faster Withdrawals. Bitcoin transactions can be completed in 10 minutes, circumventing the delays involved with bank transfers and traditional payment processors.

- Anonymous / No ID. Some bitcoin casinos do not require you to provide ID to be able to play for real money.

- Better Websites. Bitcoin is a new technology, and the development teams behind bitcoin casinos tend to have a higher level of technical ability.

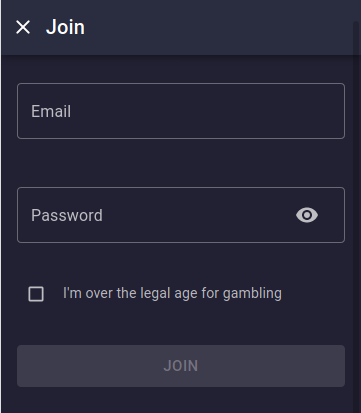

Creating an account is straightforward. You can get started in minutes.

In short, online casinos that accept bitcoin as their only deposit/withdrawal option are more efficient. They are not hobbled with the difficulties that come with providing traditional payment options, and so they can spend more of their energy on developing a better online gambling platform.

Bitcoin casinos are at the bleeding edge of online gambling.

What should you look for in a bitcoin casino?

These are the top five things I look for (in order) when checking out bitcoin casinos:

- Reliability. This is a function of age, history, and player reviews. There's no set formula for it, but if a bitcoin casino has been around for a few years without serious issues, it's a good sign. I'm open to new entrants, but 5 years of continuous operation shows a healthy amount of industry experience.

- Payout Times. Bitcoin transactions can be completed in 10 minutes, so the only delay when making a withdrawal stems from the online casino manually authorizing it. A good bitcoin casino should process withdrawals within 24 hours. Anything above that is unnecessarily slow.

- Honesty. Have a look at their "about us" pages and "terms and conditions" pages. Are they trying to communicate honestly and clearly? If you don't like how they come across, don't let them hold any of your money.

- Website Design. I know it's superficial, but first appearances count. A solid website design shows they're putting effort in to and care about what they're doing. Also, I avoid bitcoin casinos that appear to make use of tasteless marketing practices.

- Support. Always check out support to see what they're like. I know I'm in safe hands if they're knowledgeable and quick to reply. If they're slow to reply or don't seem to care, it's a red flag. Good casinos have good support.

- Native Currency. Some casinos use bitcoin as a payment method only, and your actual deposit is converted to Fiat when you play. It's good to be aware of which currency your balance is going to be held in (in case you're expecting a change in the exchange rate).

In general, your first impression is usually right. If you don't like the feel of an online casino, trust your gut and look somewhere else. There's nothing more annoying than overriding your initial feeling only to find out you were right the whole time.

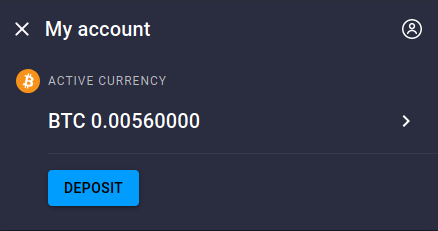

Some bitcoin casinos hold your balance in Fiat, whereas others keep it in crypto.

It's always a good idea to check out reviews from other players too, but you have to take them with a pinch of salt. People tend to only write reviews when they have something bad to say, and people who have experienced an unfortunate run of luck always like to blame the casino rather than accepting it for what it is. So keep an open mind when reading player reviews for online casinos; even the greatest online casino in the world will get at least 25% negative reviews.

I've been involved in online gambling for over 15 years, so I've got the hang of spotting a reliable casino operation. I'd like to think it's down to some sort of hard-earned sixth sense, but in reality it's mostly just common sense.

What are the risks of bitcoin casinos?

Well the obvious risk is that you choose an unreliable bitcoin casino and they disappear overnight, taking your bitcoins with them. That's the biggest risk.

The other risk is that you purchase some bitcoin and the price drops, so you lose some value. But that's something that's out of your control.

You can't control the price fluctuations. If you believe bitcoin has a future, there's no benefit to worrying about the price over the short term.

The main problem you have to navigate is avoiding the fly-by-night casino operations. Bitcoin allows anyone to send and receive money for whatever purposes they want, which opens the door for new online casinos to be able to accept gambling payments and enter the market — and not all of them will be good.

Bitcoin casinos are at a new frontier of online gambling, and whilst it brings the opportunity for new and improved gambling websites, it also brings in the ones looking for a quick buck.

Literally hundreds of bitcoin casinos have popped up since 2013/2014. Not all of them have been great. (And yes, this image is pixelated.)

This is why I've only listed and recommended a small number of bitcoin casinos on this page, and it's much smaller than what you'll find at other bitcoin casino guides on the Internet.

I'm not trying to list every bitcoin casino known to mankind here. There are lots of bitcoin casinos to choose from, but it's a quality issue not a quantity issue. I'm sure I've neglected to mention some decent operations, but for now I'm happy to have only listed the ones I am convinced are in this for the long haul.

I get a lot of search traffic for terms like "are bitcoin casinos safe?" and "are bitcoin casinos legit?". My answer to these questions is yes, but only if you're playing at a trustworthy website.

Ultimately the risk is not in using bitcoin itself… it's in choosing a casino website/company that you trust.

Why use bitcoin?

It's the most efficient way to deposit and withdraw money from online casinos.

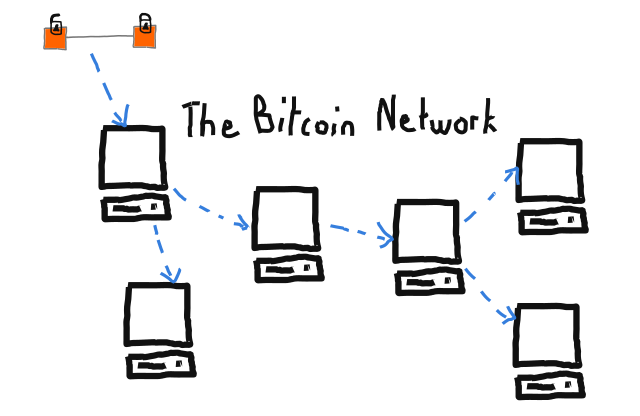

Bitcoin is digital money that operates independently of the traditional financial system. The dollars, euros and pounds that you use every day are controlled by governments and banks. But bitcoin is run on thousands of individual computers to create a payment network that cannot be controlled or censored by anyone.

Computers create a network by running the bitcoin program. Each computer on the network is called a node. (source: bitnodes.io)

And as a result, bitcoin enables free movement of money.

This is particularly relevant to online casinos because some countries (*cough* the US) like to restrict payment processing to gambling companies. Furthermore, many payment processors avoid gambling transactions for their own personal reasons, making it more difficult again to get money in to and out of online betting websites.

You've probably already noticed that online casinos do not offer all the payment methods you expect, and that withdrawals take much longer than you'd like. This is not surprising, because people who control the movement of money have worked to make online gambling slow and difficult.

Bitcoin solves this problem by not having a central point of control, which means it cannot be stopped. You don't have to ask anyone for an account, you don't have to get permission to make a transaction, and you're not restricted on where you can send money to.

Once you have some bitcoin, you're free to do whatever you want with it.

This freedom extends to online casinos too, and one of the major benefits is their new ability to process withdrawals faster than you've experienced before.

In short, bitcoin liberates the movement of money.

How do I get some bitcoin?

That's the spirit.

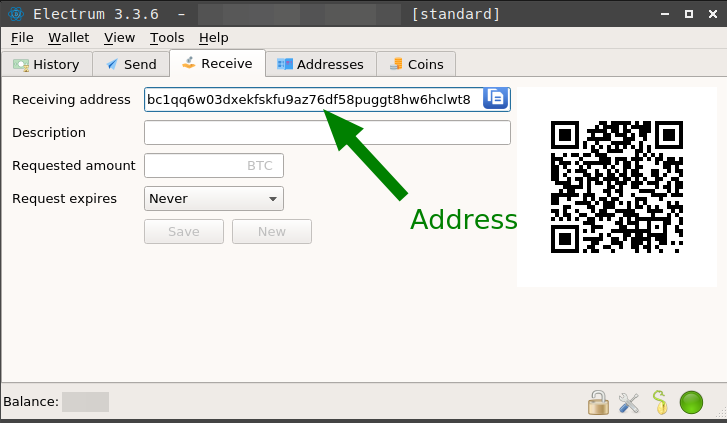

1. Wallets

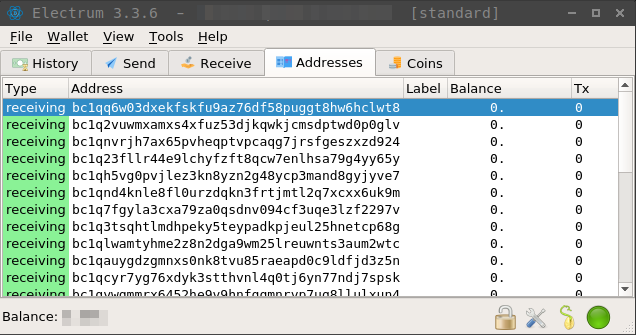

The first step is to get yourself a bitcoin wallet. This is just a program you can download that will give you addresses that you can use to send and receive bitcoins.

These are my top recommendations for getting started:

- Desktop: Electrum

- Android: Samourai

- iPhone: Blockstream Green

If you can, go for Electrum. It's my personal favorite.

A wallet just generates addresses for you so that you can receive bitcoin.

And like I said, a wallet is just a program that allows you to store your bitcoins.

You technically don't have to download your own wallet, but if you're getting in to bitcoin you may as well get in to it properly and actually control your own bitcoins as opposed to letting a company or website control them (I'll get in to that later).

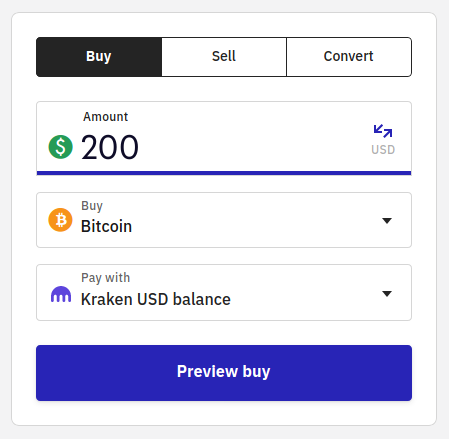

2. Buying

Anyway, once you've got a wallet set up, you can buy some bitcoins. Here are some popular places to buy bitcoin:

I'm haven't listed every possible destination for every country, but these exchanges are a good place to start.

You can usually buy bitcoin from these places via card or bank transfer.

Exchanges like Kraken make it easy to buy and sell bitcoin.

But at the end of the day, if your friend has some bitcoin and they're happy to sell you some, there's no reason why you can't buy from them directly. Exchanges are just there as a convenience.

Bitcoins are divisible down to 0.0000001 BTC (this is the smallest unit of bitcoin and it's called a satoshi). You can buy as little or as much bitcoin as you like.

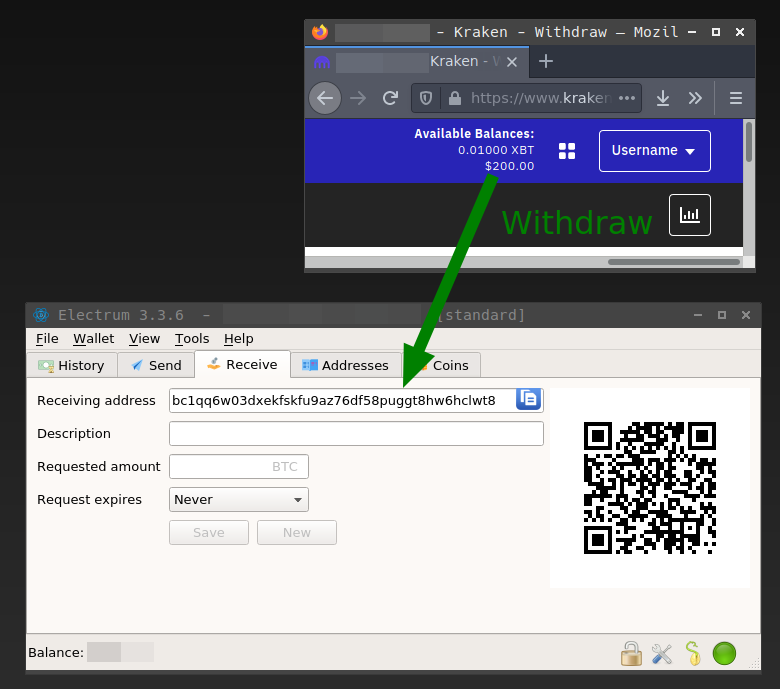

3. Withdrawing

Once you've successfully purchased some bitcoin from a website (congratulations), those bitcoins are going to be sitting in your online account. From here you should withdraw them to your wallet.

All you need to do is withdraw them to an address in the wallet you downloaded.

Moving the bitcoins from the exchange to your wallet.

Why? Because by sending the bitcoins to an address you own you take full control of your bitcoins.

If you leave your bitcoins in your account on an exchange, they're not actually your bitcoins… they're still controlled by the exchange. So if the exchange disappears, so do your bitcoins.

Analogy. Keeping bitcoin on an exchange is like having a certificate saying you own an amount of gold, instead of actually having the gold in your hands.

You could argue that it's more convenient to leave your bitcoins on an exchange and avoid the responsibility of managing your own bitcoins. That's fair enough — just as long as you're aware that you're leaving the security and control of your coins in the hands of the exchange.

But for me, bitcoin was designed to give you freedom over your own money, and withdrawing your coins to your own wallet is in the true spirit of bitcoin.

Because once you've got control of your own bitcoins, they're yours.

How do I use bitcoin?

The best way to get the hang of bitcoin is to use it.

Send some bitcoin from one address to another and see what happens. After you've made your first successful transaction you'll feel more comfortable instantly.

It's not as scary as you think.

But to help get you going, are some explanations of the basic elements of using bitcoin…

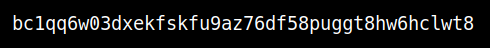

1. Addresses

An address is what you use to receive bitcoin.

You can think of it as an "account number". They are long strings of characters, which can look intimidating at first, but this is just to ensure that every address is unique.

An address is a unique alphanumeric string. They represent extremely large numbers, which means nobody else will generate the same addresses as you.

Your wallet will generate addresses securely for you on your behalf.

There is no limit to how many addresses you can generate, so feel free to use a new address every time you want to receive bitcoin.

For privacy purposes it's recommended to use a new address every time you receive bitcoin. There's no limit to how many addresses you can generate, so you shouldn't feel restricted to use the same ones over again. By using new addresses you create a separation between the coins you receive so they're not all connected at the same address.

2. Transactions

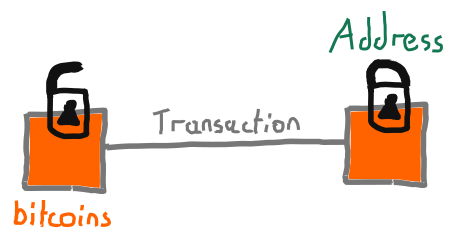

A transaction allows to send bitcoins on to someone else.

When you make a transaction you're basically taking some bitcoins you control, unlocking them, and locking them up to someone else's address.

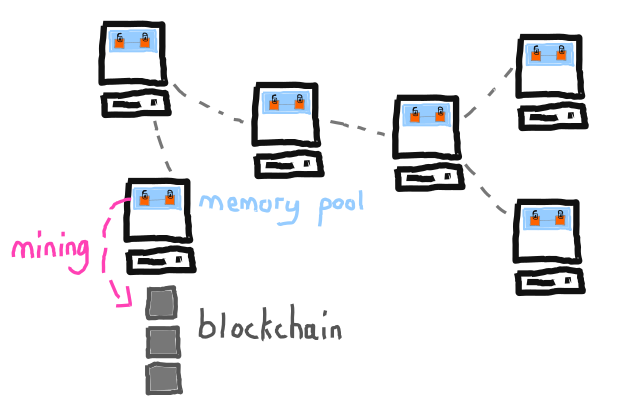

This transaction is then sent in to the bitcoin network (by your wallet), and gets propagated across all the computers on the network.

The transaction will initially be held in the memory pool, which is like a waiting area for all the most recent transactions on the network. From here you just need to wait about 10 minutes or so for the transaction to get mined on to the blockchain.

Getting your transaction mined is also known as getting a "confirmation".

Anyway, once the transaction has been confirmed, the transaction is complete and it cannot be undone.

3. Fees

By increasing the fee on a transaction you increase the priority for getting it mined on to the blockchain.

In other words, the fee allows you to speed up the time it takes to get a confirmation.

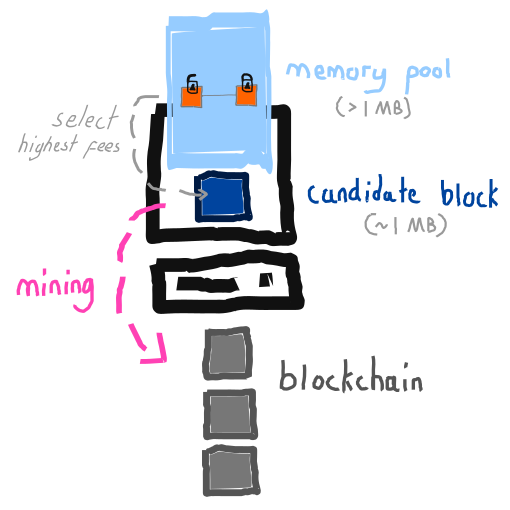

You see, only a fixed volume of transaction data can be added on to the blockchain in each block (with new ones only being mined every 10 minutes on average), so if lots of people are sending transactions in to the bitcoin network at the same time, there will be lots of competition for space in the the next block, and not all of them will be able to fit.

In this situation miners fill their candidate block with transactions with the highest fees on them, because they can collect these fees if they are successful in mining the block.

So the fee you put on your transaction acts as an incentive for a miner to include it in their next candidate block, which in turn increases the chances of your transaction getting mined quickly (depending on what fee you use and the current competition for block space).

When you make a transaction your wallet should suggest an ideal fee given the current size of the memory pool. They should also give you an estimate for how long you can expect to wait for your transaction to get confirmed based on the size of the fee.

Setting a fee on a transaction in Electrum.

There's no perfect fee amount. But in general:

- The higher the fee, the more quickly your transaction will get confirmed.

- The lower the fee, the less quickly your transaction will get confirmed.

If you want your transaction to get quickly, increase the fee. If you don't care about the transaction being completed as soon as possible, feel free to use a lower fee and wait for it to get mined later on when there's less competition for space in a block.

It's completely up to you what fee you use. If you're new, I'd stick with the default suggestion in your wallet and go from there. If you're more advanced, you can check out the current state of the mempool and adjust your fee based on that.

But like I say, there's no perfect fee size, so don't stress about it too much. You're not going to lose bitcoins by setting too low a fee on a transaction (you'll just lose time waiting for it to get confirmed).

The first time is always confusing, but you get better at setting fees with every transaction you make.

Don't put an unnecessarily high fee on your transaction. If your fee is high enough to help your transaction get in to the next block, increasing the fee any further will not make it go any faster and is just a waste of money.

If you put too low a fee on your transaction it may hang in the memory pool for a few days. If it doesn't get confirmed it will eventually leave the memory pool and you will have to send the transaction again. This is perfectly normal, but waiting can be annoying.

4. Confirmations

A confirmation means your transaction has been permanently written to the blockchain and is now irreversible (almost).

Further confirmations just mean further blocks have been mined on top of the block your transaction is in. It's very difficult for anyone to be able to remove a block once it gets in to the blockchain, and it gets progressively harder for an attacker to replace blocks in the chain the further down you go.

Technically speaking, the uppermost blocks on the chain can get replaced, and so by waiting for more than one confirmation you're making sure that it's going to be impossible for anyone to be able to remove your transaction from the blockchain.

But anyway, how many confirmations should you wait for?

- 1 Confirmation. This is good enough 99.9% of the time.

- 2 Confirmations. This is better for the rare situation where the top block in the chain naturally reorganizes (and your transaction has to get mined in to the blockchain again). This happens about once a month, or roughly 1 in 5,000 blocks.

- 3+ Confirmations. This is best if you suspect there is a network-scale attack against bitcoin to try and rewrite the most recent blocks in the chain.

Personally, once I see a transaction get one confirmation I consider it to be done. But then again, if I was receiving payment for a house in bitcoin I'd probably wait for 2 or 3 confirmations before transferring the house to the other person.

So one confirmation is enough for practical purposes, but wait for a couple more if you need extra assurance.

A transaction in the memory pool should not be relied up as having transferred any money. It can always leave the memory pool (especially if it has a low fee), and if it does it will be like the transaction never took place. Always wait for at least one confirmation.

How do I keep my bitcoins secure?

Keeping your bitcoins secure isn't complicated. It's merely a handful of basic but important principles…

1. Software Wallets

Always use trusted wallet software, and download it directly from the wallet's website.

This is the one I recommend the most:

- Electrum. Created by Thomas Voegtlin, a computer scientist who specialized in machine learning before starting development on Electrum in 2011. It doesn't have the most beautiful interface, but it's as reliable as they come.

This is not the only reliable bitcoin wallet in the world, but it is my personal favorite.

When it comes to bitcoin wallets it's not about going for the shiniest one you can find – it's about using one that has a proven history. A wallet's job first and foremost is security, and having a cool GUI doesn't make it any more secure.

Be judicious in your choice of bitcoin wallet software, because you're going to be trusting it with the security of your money.

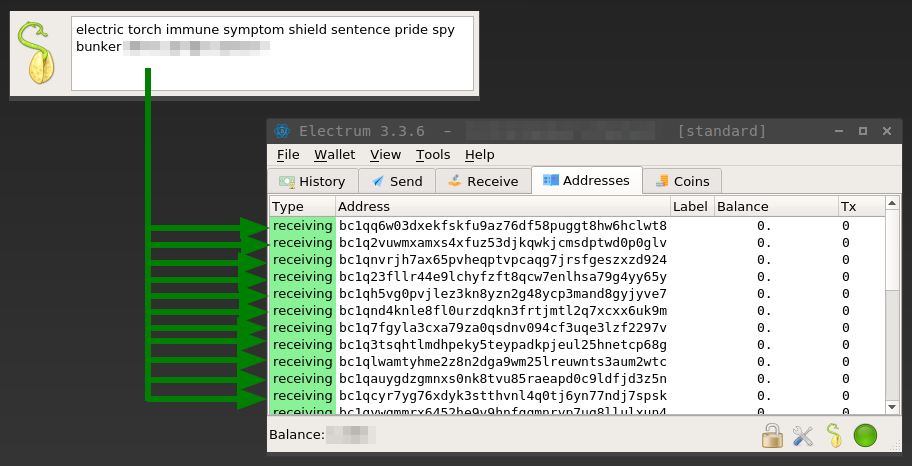

2. Seed

Your seed is the source of all your bitcoin addresses and keys. Write it down and keep it safe.

You can use your seed to recover all of your bitcoins if your computer breaks. All of the addresses in your wallet are generated from this seed, as are all the private keys needed to unlock and spend them. So if you've got a copy of your seed, you can always recover your bitcoins.

A seed is usually 12-24 words long, and it allows you to regenerate all your addresses in the event your computer breaks.

But this also means that if someone else sees your seed, they can take all of your bitcoins. So you need to be careful about where you keep it.

- Do not store it in a text file on your computer. This is the most common mistake. An unencrypted file on your computer is the riskiest storage place for a seed.

- Do not take a screenshot of your seed. This is just as bad as storing your seed in a text file, or worse. I had a friend who screenshotted their seed and synced their screenshots to Dropbox… they lost their bitcoin.

- Do not enter your seed in to a website. Never, ever, not even once, enter your seed in to a website. This is literally giving your seed away. Any website that asks you for your seed is an outright scam.

- Do not try to memorize your seed. Just because you can memorize 12-24 words it doesn't mean you should. Memory comes and goes, and a seed that you rarely need to recall is going to be first in line to get kicked out of the memory banks.

The easiest option is to write your seed on paper. This way it's not connected to the Internet and you don't have to worry about any digital attacks.

If you want to take it up a notch you can store your seed on steel (for example a CryptoSteel or BillFODL), which means your seed will remain intact in the event of a house fire or explosion.

But the key point is to keep your seed away from the Internet where possible, and to store it somewhere safe.

Try not to make your seed storage too complicated. Keeping it in one physical location is the best option for most people. You could split your seed up in to multiple pieces and store it across multiple locations (for extra security), but the more complex you get the more likely it becomes that the only person you prevent from recovering your seed is yourself.

Password Managers. Storing your seed encrypted in a password manager like KeepassXC is a valid option. But if you're new to bitcoin, keeping your seed offline is the best place to start.

3. Hardware Wallets

If you've got an amount of bitcoin that you're afraid to lose, store it in a hardware wallet.

A hardware wallet is basically a mini-computer that provides all the functions of a software wallet, except it does not have an Internet connection (it connects to a computer via USB instead). This means all of your private keys inside your wallet are never exposed to the Internet, so they're not at risk from any malicious programs that you may accidentally download.

A hardware wallet keeps your coins safe from viruses. This is the Trezor Model T.

This is not to say your desktop wallet is vulnerable by default. I've used Electrum for years and never had a problem. But still, a hardware wallet gives you that extra layer of security.

These are the best hardware wallets available at the moment:

- Trezor. Excellent hardware wallet. Easy to use for beginners (and just as good for experience bitcoin users).

- Coldcard. Another excellent option. Aimed at more advanced users.

A hardware wallet isn't necessary for everyone — you can use bitcoin safely without ever having to use one.

But if you're sitting on a bunch of bitcoin and want to find a way to keep it even more secure, get yourself a hardware wallet.

Tip. Most people keep their day-to-day bitcoin in a software wallet, and keep their savings in a hardware wallet. It's like keeping some money in your handbag, and keeping the rest in a locked safe.

Ledger. Ledger is another popular choice, but in July 2020 they had a security breach where the physical addresses of everyone who had purchased one of their wallets was leaked to hackers. Their devices are still secure, but I no longer recommend them as a company.

4. Other Tips

A few more security tips I'd like to mention:

- Don't tell anyone how much bitcoin you own. You're the only person between you and your bitcoin. If people find out that you have an amount of bitcoin worth stealing, you open yourself up to a $5 wrench attack (amongst other physical attacks).

- Keep it simple. Simplicity is your friend. By making your security needlessly complex you primarily increase your chances of locking yourself out.

- You're in control. Bitcoin is straightforward, and you shouldn't be afraid of using it. Don't let anyone tell you what you should or shouldn't do with your bitcoin. It's your bitcoin, and it's your choice what you do with it. If you want someone to tell you what to do with your money, deposit it in to a bank instead.

Other than that, have fun.

Frequently Asked Questions

Who invented Bitcoin?

Bitcoin was created anonymously under the pseudonym Satoshi Nakamoto.

Nobody to this day knows who Satoshi Nakamoto is.

He or she first appeared on the Cryptography Mailing list in November 2008 to announce a new "electronic cash system" they had been working on, before releasing the first version of their Bitcoin software on Friday 9th January 2009. The open source code (initially one giant C++ file) was hosted on Sourceforge for download, and it only ran on Windows.

Satoshi Nakamoto's motivation for creating a decentralized currency was in response to the 2007-2008 financial crisis, caused by excessive risk-taking by banks which in turn affected the lives of everyday people. Satoshi wanted to provide an alternative to mitigate the monopoly modern banks have on the control of money:

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without the burdens of going through a financial institution.

– Satoshi Nakamoto (01 Nov 2008)

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

– Message embedded in to the genesis block (03 Jan 2009)

Satoshi remained active on the Cryptography Mailing list and on the Bitcoin Talk forums for the first two years of Bitcoin's life, before making their last forum post on 12th December 2010. This was a day after the first large-scale exposure of bitcoin in the press (related to WikiLeaks and an article in PC World), to which they replied:

WikiLeaks has kicked the hornet's nest, and the swarm is headed toward us.

– Satoshi Nakamoto (11 Dec 2010)

From this point onwards, Satoshi Nakamoto removed his/herself from public view.

However, three years later there was a furore around the possible identity of Satoshi Nakamoto, with many people pointing toward a man from California named Dorian Nakamoto. Satoshi broke their silence to help draw the press attention away from Dorian:

I am not Dorian Nakamoto

– Satoshi Nakamoto (7 Mar 2014)

And that's the last we have heard of Satoshi Nakamoto.

Note: If you're interested in learning what kind of person Satoshi was/is, you can read a collection of all their public emails and posts at the Nakamoto Institute.

Is bitcoin a waste of energy?

Bitcoin uses energy to secure the blockchain.

The more energy used in mining (adding new blocks of transaction on to the blockchain), the more difficult it becomes for any individual to remove transactions already written to the blockchain.

In other words, Bitcoin turns energy in to security, and it uses that security as the basis for a global payments system.

In an ideal world we would be able to send money across the Internet securely without requiring the use of energy to fortify the transaction history. But such a system doesn't exist. Until then, Bitcoin is the best solution we have for a digital payment network that operates independently and without a single point of control.

Bitcoin is not perfect, but it's not competing against a perfect monetary system. Fiat currencies like the dollar are created cheaply, but its value is secured through economic policy and war. Gold has a fixed supply, but the environment is damaged in the process of extracting it from the earth (not to mention that costs of moving it large distances).

In comparison, Bitcoin is arguably the most cost-effective value transfer system currently in existence.

Can I mine bitcoin?

You can, but mining has become so competitive that you need to use specialized hardware (and ideally have access to cheap electricity) to make it worthwhile.

Back in the very early days of bitcoin you could mine using the CPU on your laptop. But as the price increased and mining became more profitable, people switched to using GPUs (because they were faster), and then eventually ASICs were designed which could mine even faster again. So now unless you're using an ASIC, you're going to spend more money on electricity than you will make from any bitcoin you are able to mine.

So like I say, you need to buy specialized equipment to come anywhere close to making a profit from mining. If you do decide to set up a mining rig, most solo-miners join a mining pool so that they can earn bitcoin for their contribution, as opposed to attempting to mine blocks on their own (which would equivalent to winning the lottery).

So yes, you can mine bitcoin, but it takes dedicated effort, and today the rewards are small in comparison.

Is it "Bitcoin" or "bitcoin"?

It depends on what you're referring to:

- "Bitcoin" - The software or the system as a whole. (e.g. "I'm a big fan of Bitcoin")

- "bitcoin" - The unit of currency. (e.g. "I bought one bitcoin yesterday")

Sometimes I use them interchangeably and hope that no one notices.

What are the bitcoin denominations?

A whole bitcoin can be broken down to eight decimal places: 1.00000000

There are some common denominations for different unit sizes along the way:

| BTC | 1.00000000 | |

|---|---|---|

| mBTC | 0.001 | one-thousandth of a bitcoin |

| uBTC | 0.000001 | one-millionth of a bitcoin (sometimes referred to as a "bit") |

| satoshi | 0.00000001 | one-hundred-millionth of a bitcoin (the smallest possible unit) |

https://en.bitcoin.it/wiki/Units

One bitcoin (1 BTC) is the standard unit, but it has become too high in value for it to be practical in everyday usage. As a result people have moved on to using mBTC and uBTC in some places, but there's no universal standard.

My advice is to use satoshis as your base unit, and remember that there are 100,000,000 of them in one bitcoin.

Or try to remember anyway.

Where can I learn more about Bitcoin?

The best place to start is with the original Bitcoin Whitepaper.

If you're interested in the technical side of how bitcoin works, check out Learn Me A Bitcoin. There's a lot of solid information in the Bitcoin Wiki too.

Beyond that, this is a cool curated list of resources by Jameson Lopp.

A lot of the interesting technology behind bitcoin gets lost amongst fervent price talk and evangelism, so if you genuinely want to learn more about Bitcoin it's best to avoid places like Reddit and Twitter (although they can be fun at times).

Bitcoin is a deeply interesting technology to learn about, and many people often describe it as "falling down a rabbit hole". I should know.

Just be careful not to get distracted by all the surface-level noise. There's more to Bitcoin than you think.